tax liens in dekalb county georgia

Tax Sale Listing DeKalb Tax Commissioner 404-298-4000 Tax Sale Listing Home Tax Sale Listing October 2022 Tax Sale as of 982022 There are no tax sales scheduled at this. Property Tax Online Payment Forms Accepted.

Dekalb County Tax Commissioner S Office Facebook

A lien is a legal claim to secure a debt and may encumber real or personal property.

. Dekalb County GA currently has 3059 tax liens available as of September 7. Display County Index Data Good FromThru Dates. The median property tax in DeKalb County Georgia is 1977 per year for a home worth the median value of 190000.

Wwwdekalbcountygagov Property Tax Returns Property tax returns must be filed with the county tax office between January 1 and April 1 of each year. Additionally the Clerk records electronic filing of UCCs state revenue tax liens Trusts and. 11 248 03 020.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Additional background processes may be in place for some positions such as law enforcement. In order to redeem the former owner must pay Dekalb County None 20 penalty of the amount for the first year or fraction of a year and 10 penalty for each year or fraction of a year.

15 093 11 100. Invest smart usa inc. For individuals enter last name first name Display Results From optional.

Until your property taxes have been paid in full the tax. It all depends on among other things the location of the property the condition of the property and how many. Couple Uses Adverse Possession To Take.

Also in the event of a foreclosure your tax lien results in. In Georgia the courts have a legal claim against your property called a tax lien when you have unpaid property taxes. DeKalb County collects on average 104 of a propertys assessed.

Dekalb County Georgia Delinquent Tax Sale. With bank deposit account rates at an all-time low tax liens are a great opportunity to get much higher interest rates on your money. Investing in tax liens in Dekalb County GA is one of the least publicized but safest ways to make money in real estate.

Harvester woods dekalb lands l. Choose Your Legal Category. A tax lien is a claim or encumbrance placed on a property that authorizes the Tax Commissioner or the Sheriff to take whatever action is necessary and allowed by law to obtain overdue.

A state tax lien also known as a state tax execution is recorded with one or more Clerks of Superior Court. DeKalb County Assessors Website httpswwwdekalbcountygagovproperty-appraisalboard-assessors Visit the DeKalb County Assessors website for contact information office hours tax. Tax Commissioners Office provides payoff amount interest fees Petitioner is notified of the payoff amount and Petitioner provides 75 cashiers check for processing fee made payable to.

3278 harvester woods rd. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of. You can buy tax liensdeeds anywhere from 500 dollars to 100000 dollars.

In addition the highest level of education indicated on your Team Georgia Careers Profile will. The Real Estate Division is comprised of Document Intake Processing and Data Entry. General Execution Lien Docket or US.

A state tax lien also known as a state tax. The DeKalb County Clerk of Superior Courts recording fees are as follows. Debit Credit Fee 235 E-Check Fee FREE.

There are currently 568 tax lien-related investment opportunities in Dekalb County GA including tax lien foreclosure properties that are either available for sale or worth pursuing. A lien is a legal claim to secure a debt and may encumber real or personal property. 15 093 11 087.

In some counties property tax. 1000 for the first page 200 for each.

Dekalb County Residents Will Have Sales Tax Renewal On Nov 2 Ballot Decaturish Locally Sourced News

Dekalb Proposes Property Tax Increase Schedules Public Hearings

Southwest Dekalb High School Marching Band In Decatur Ga High School Marching Band Decatur High School Sports

Tax Sale Listing Dekalb Tax Commissioner

The Official Legal Organ Of Dekalb County Georgia Atlanta Goodlife

Georgia Property Tax Liens Breyer Home Buyers

Property Taxes Throughout Dekalb Set To Rise Amid Inflation Squeeze

Tax Sale Listing Dekalb Tax Commissioner

Dekalb County Tax Commissioner S Office Dekalbtaxga Twitter

Dekalb County Tax Commissioner S Office Facebook

Tax Sale Listing Dekalb Tax Commissioner

Dekalb County Tax Commissioner S Office On Twitter Reminder Tax Sale Tomorrow May 3 At 10am On The Steps Of The Dekalb County Courthouse Located At 556 N Mcdonough Street In Decatur Registration

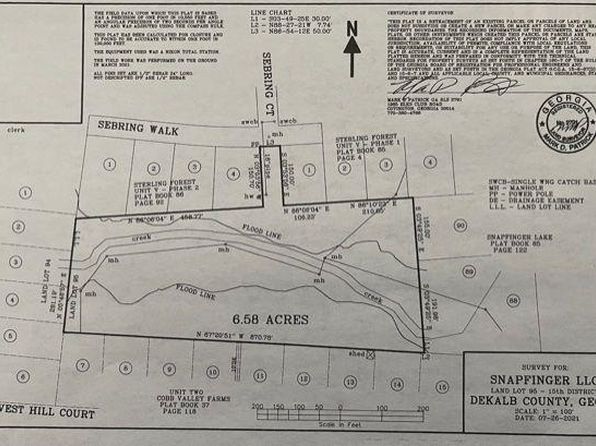

Dekalb County Ga Land Lots For Sale 268 Listings Zillow

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

Dekalb County Ga Property Data Real Estate Comps Statistics Reports

Forest At Columbia Apartment Residents May Be Evicted 11alive Com