is there a tax on death

When a person dies and their. If the deceased had not filed individual income tax returns for the years prior to the year of their death you may have to file.

Life Death And Taxes In Inequality City The New York Times

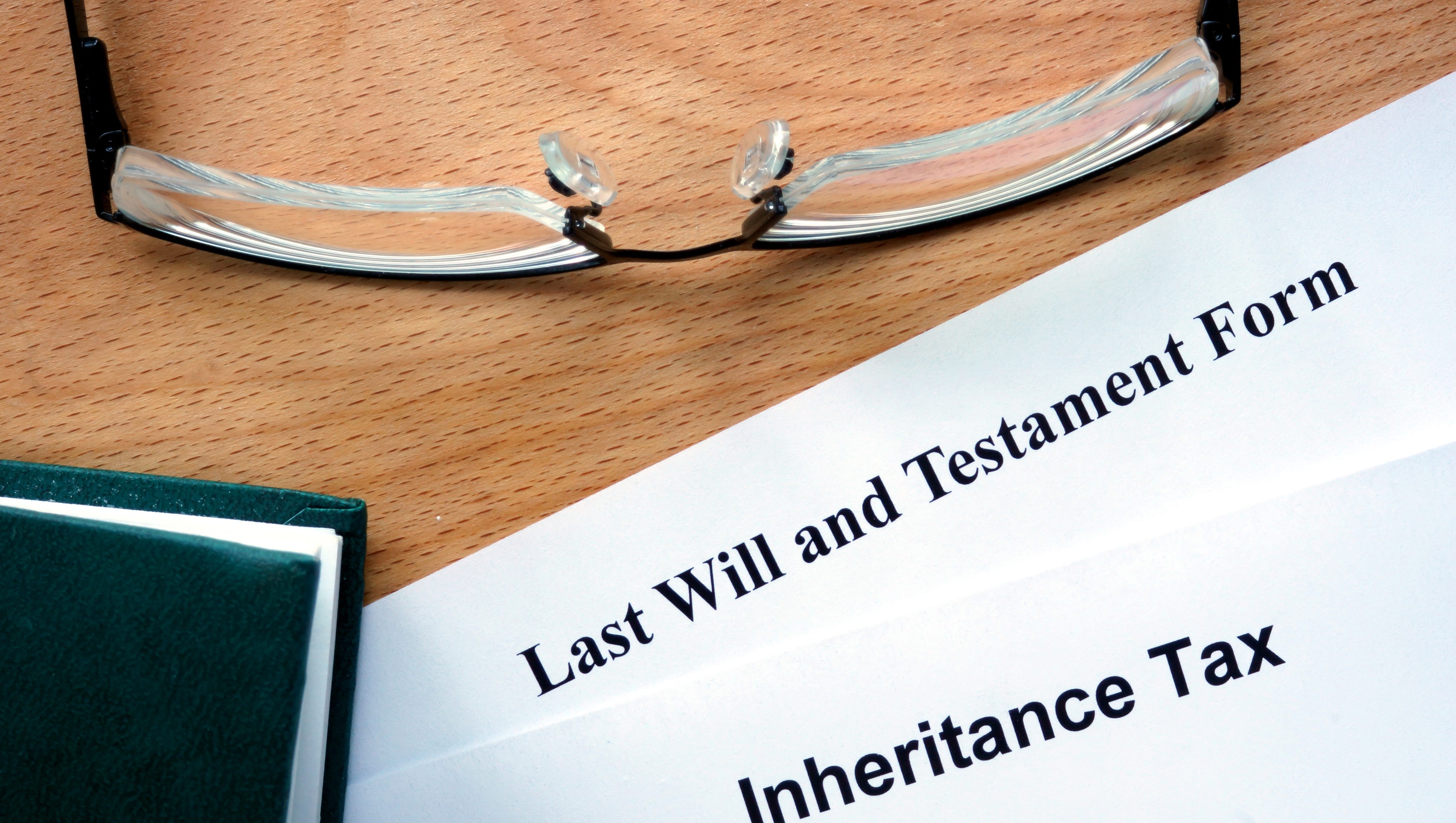

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000.

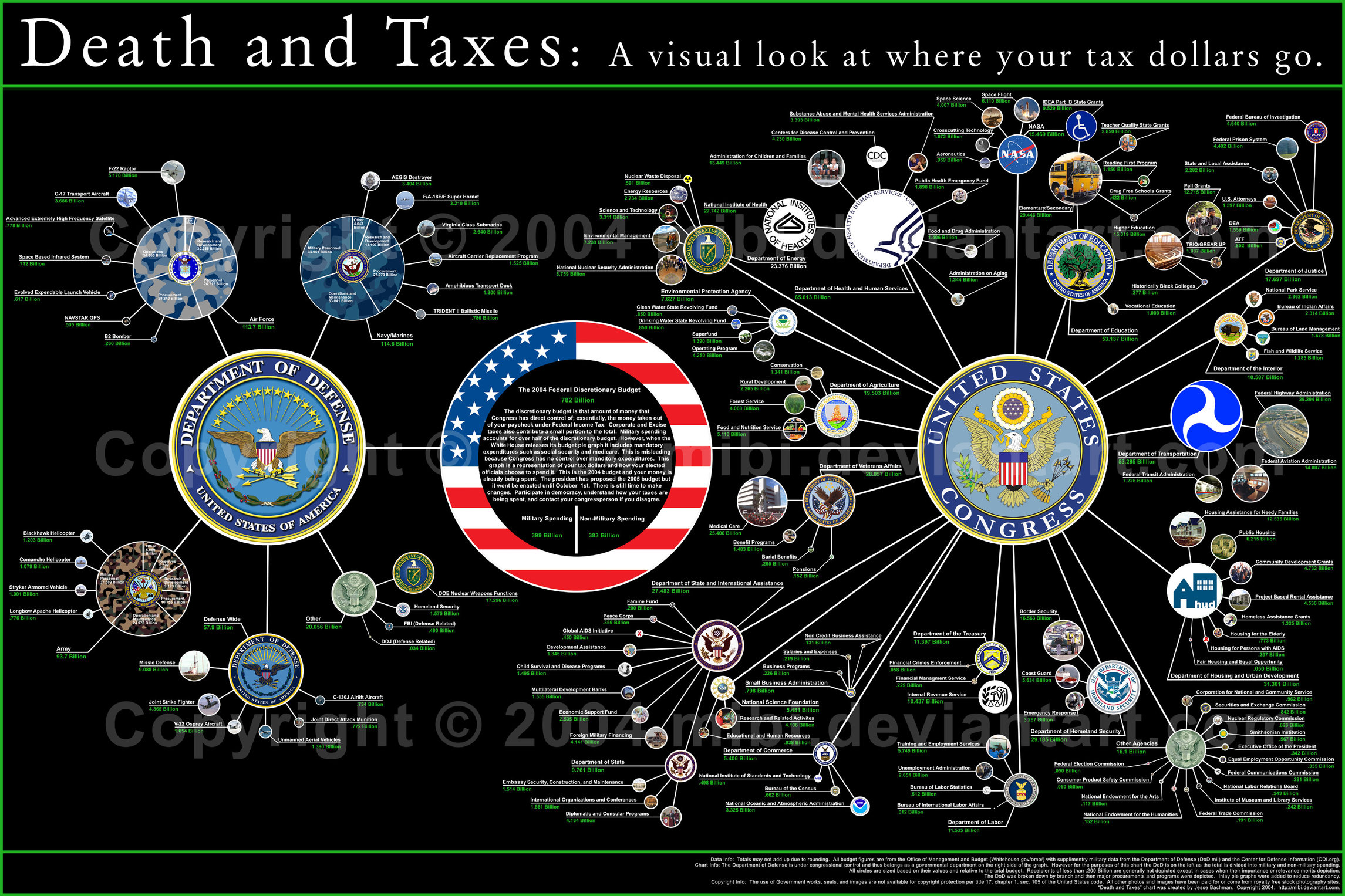

. The dollar criteria change each year. But is there a valid public policy. The estate tax which is levied by the federal government and certain states and the inheritance tax which is.

Estate and Gift Tax Based on Value of Assets. There is a Federal estate tax that applies to estates worth more than 117 million. The Internal Revenue Service IRS imposes an estate tax on the value of all of an estates assets at the time of death.

So estates are a relatively easy target for the tax collectors. Its your responsibility to pay any balance due and to. That amount increases to 1206 million for the 2022.

When you take sole ownership of the account after the date of your co-owners death youll become fully responsible for paying any tax that comes due on income earned by. There is a federal tax where the IRS taxes portions of your estate. While there are no direct taxes on death family members must understand certain tax rules to avoid a significant tax bill.

The decedents income will count from January 1 of the year they passed until the day before they passed. In addition the Green Book conspicuously ignores the estate tax. And depending on where you live there may be state.

Your estate is worth 500000 and your tax-free threshold is 325000. The estate tax is a tax on your right to transfer property at your death. The IRS says that the.

Federal capital gains possible state. This means that there would be effectively two or even three death taxes. At death there is a little-known tax benefit that the federal government provides.

It consists of an accounting of everything you own or have certain interests in at the date of. Write deceased next to the taxpayers name when filling out tax. Estate and Gift Taxes.

All the assets of a deceased person that are worth 1170 million or more as of 2021 are subject to federal estate taxes. It is an adjustment to tax basis and it can have a profound effect on the taxation of the assets. The estate can pay Inheritance.

The death tax is an informal name for the federal estate tax. In the US there are actually two different kinds of death taxes. No not every state imposes a death tax.

There are two types of estate taxes that can be imposed after death. If the policys current cash value exceeds the gift tax exclusion of 15000 in 2021 and 16000 in 2022 gift taxes will be assessed and due at the time of the original. File Form 706 for estates with assets that exceed 12060000 for 2022 date of deaths.

The term is also sometimes used to describe inheritance or estate taxes levied by a state. Every taxpayer has a lifetime estate tax exemption. Only 12 states plus the District of Columbia impose an estate.

But after death ownership tends to be dispersed and in many cases unresolved.

Death And Taxes Personalized Poster Zazzle

130 Inspirational Quotes About Taxes Inc Com

Avoiding Double Tax On Death Tpc Financial

Jamaica Gleaner Benjamin Franklin Once Said There Are Two Sure Things In Life Death And Taxes We May Not Even Realise That In Death There Are Taxes To Be Paid

The Coalition Says Labor Plans To Introduce A Death Tax If It Is Elected Is There Any Evidence Abc News

The Death Tax Needs To Die Foundation For Economic Education

Death Tax Definition Qualification Example How To Reduce

Death Tax Types Of Taxes Imposed After Death Trust Will

Spouses Tax Liability At Life And Death David Klasing Tax Law

The Box Is There For A Reason Of Death And Taxes And Cockroaches The Box Is There For A Reason

Wallace What Taxes Do I Have To Pay When I Sell Inherited Property

What Is A Death Tax And Will You Have To Pay One Fox Business

Death And Taxes Adam Smith Institute

Filing A Final Income Tax Return After The Death Of A Loved One

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Cc Biz Buzz Tom Stauder Is There A Death Tax Cc Connected

Solved At The Present Time There Are Basically Two Types Of Chegg Com